When I introduced myself to you a little over a month ago (see “From Small Change to Serious Money“), I told you I was an investor.

I have an account at Etrade.com and I invest money in shares of companies that I think will appreciate in value over time. This post is about my personal rules for investing, but you’ll see it has some relevance to what I’ve been doing in the Pay-To-Click sites.

1. INVEST FOR THE LONG TERM.

When I use my money to purchase shares of stock in a company, I don’t expect to see that money again for a long time. I will own shares for a year or two or three, or in some cases for as long as 10 years or more. I am not a “day trader” who speculates on whether a particular stock will go up or down in a few hours. I do not invest money only to pull it out a short time later. I’m not looking to make money fast.

What I have come to know with certainty is that over time, the value of well-run companies increases, and that if I wait I can double or triple my investment. This is old-school investing and it takes patience. It’s the kind of investing I learned from my parents, who learned it from their parents.

My grandfather on my Mom’s side was the manager of a Woolworth’s department store in Witchita Kansas during the Great Depression. He didn’t make a lot of money, but he was a saver. He put money aside to invest the same way I am doing now.

You don’t need to be rich to invest, you just need to save a bit of money to start with.

The money you save and invest in the stock market is money you should expect you will never see again. It is money you do not need right now, money you can afford to risk. It will always be invested, and always working for you to make more money.

Investing for the long term is one of the basic rules I follow in order to withstand the short-term ups and downs of the marketplace and benefit from the long-term growth of the broader market.

I am 57 years old, but it may surprise you that I did not actually start investing until I was in my early 40’s. I’ve only been investing for about 15 years, and the total amount of my own money that I have put into the stock market was just $10,000.

2. NEVER WITHDRAW PRINCIPLE.

My total out-of-pocket investment during my first 5 years of investing was $10,000. That was my principle.

I expect to keep that $10,000 invested in the stock market until I die. That money is always working to create more money. As it grows, I sell some stock and either reinvest or take money out. I have taken out about $13,000 over the years, and what remains invested has grown to nearly $40,000 today.

My Etrade balance will never be less than $10,000.

During the Great Recession of 2007-2010, my balance did actually drop to $8,000. When that happened, I put $2,000 in to bring it back up to $10,000. And as we emerged from the recession the market returned all of the value it had previously held. Those companies I had invested in were not any less valuable during the recession… but a lot of people were desperate to sell because they were afraid, and that drove stock prices down.

After my initial $10,000 investment, I occasionally sold shares and bought shares — all using the new money my initial $10,000 had earned. Over the past decade I have bought and sold some $60,000 worth of stock in various companies. But I have never let that original $10,000 leave my Etrade account, and I don’t expect I ever will. It will always be there working to make more money.

3. ONLY ONE TRADE PER DAY.

Let’s be clear: I do not trade stocks every day. So far this year I have only sold nine times, and I have only bought five times.

Only 14 trades this year… and never more than one trade on any given day. The reason for this rule is because a trade creates a paper trail, and it helps not to have more than a single trade on any given piece of paper. It’s easy to keep track of when I am looking for that piece of paper a few years later.

I also use a spreadsheet to record my Buys and Sells. So only one Buy or Sell per day keeps the spreadsheet simple.

4. BUY AS MANY SHARES AS POSSIBLE FOR $500. (Or $1,000.)

$500 is usually what I spend to buy shares in a company I have not previously owned. If it does well I may buy another $500. And another. As the price goes up, I buy fewer shares for my $500. And occasionally I buy more shares in a company even when the price has gone down; then my $500 buys more shares. This is known as “dollar cost averaging.” I take it a step further and apply the idea to purchasing shares in a particular company. As the company increases (or decreases) in value, I can invest the same amount but buy fewer (or more) shares.

Dollar cost averaging is a way to minimize exposure to the normal ups and downs of the market and profit in the long term.

Some share prices are more than $500. Google, for instance, has traded above $800 per share in recent months. So if I want to buy more Google I’ll need to spend more than $500. That’s an exception — most companies’ stock trades at less than $500 per share, so I can buy one, or four, or eight, or more shares for $500, depending on the share price.

Of course I don’t purchase any shares in a company unless I expect it to at least double in value.

5. WHEN AN INVESTMENT DOUBLES IN VALUE, SELL HALF.

This is a rule I learned from a friend who has done very well with investing.

In the stock market, there will be losers and there will be winners. Many stocks will double in value over the course of a decade or less. If you sell half when a stock doubles, then you have recovered your initial investment and you still have something invested in that stock which can grow further. The money from sold shares you can reinvest in something new.

You may be tempted to think the opposite is also true: if a company loses half it’s value then sell half of it. But I am less sure about this rule. A company that has lost half it’s value has really been battered. Is the beating deserved? That’s where you have to do your research and exercise your best judgement.

Here’s an example. A year ago Apple hit a high of $700 per share. Then there was a big sell-off when most people thought it couldn’t possibly go any higher. The company had run out of new ideas, they said. Apple lost about half it’s value within two months and was trading around $350. Would that have been a good time to sell?

I’ve been a long-time investor in Apple, and I concluded the company was seriously undervalued. I didn’t sell anything. It has since come back; though not to the same level — yet.

Here’s a more typical example. I purchased shares in Texas Instruments back in 2009. (It makes components in some of the world’s most popular cell phones.) It had doubled in price a year later so I sold half. Two years later it had doubled again, so I sold half of my remaining shares. I still own 24 shares, so if it goes higher I can make more money.

6. MONITOR INVESTMENTS DAILY.

I’m not obsessive about it but I do pay attention to what the stock market is doing, and I check my portfolio nearly every day. Sometimes I am watching to see if it’s time to sell. (Something has doubled.) Or I’ve picked up some news about a stock I’m interested in buying and I am watching for a dip in it’s price.

The thing is I have a sense of how things are going all the time, and there are particular things I am paying attention to on any given day.

I can’t imagine going for weeks or months at a time without knowing how my investments are performing. Vigilance helps me continue to make more money in the stock market.

INVESTING IN PAY-TO-CLICK

EARNINGS

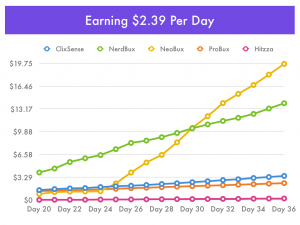

$39.79

All these rules have some usefulness when it comes to making money in the Pay-To-Click advertising space.

- If you invest in well-run PTCs I believe you will earn a rewarding return — perhaps doubling or tripling the amount you initially invest.

- The longer your money is invested in PTCs and working for you, the more you will make.

- Decide what you are willing to spend — on upgrades, rentals, and advertising — and invest regularly.

- Click every day to earn as much as you can, and monitor how your money is working for you.

- Use a spreadsheet to track your spending and earning, and keep good notes about your activity.

- Do only one purchase or withdrawal per day and make note of it on your spreadsheet.

- Watch for specials: advertising discounts, rental discounts, account funding bonuses, etc. and buy as much as you can.

- Reinvest earnings to grow your income.

- Diversify your holdings by adding other PTCs to your portfolio.

Do you have a different strategy in Pay-To-Click? Not everyone thinks about this business like an investor. Where do you put your money — into rentals? Or advertising? How quickly do you want to become profitable? What will you do with the money you earn from PTCs? Will you reinvest? Post your comments below.

The guys at TimTech SOLD NerdBux on March 18, 2014.

Please read the blog post I wrote about the events leading up to the sale: “The Rise and Fall of NerdBux.”

Earnings dropped off quite a bit after the sale… but not to zero. I am still logging in every day and clicking all available ads, and earning money.

No, I don’t think NerdBux is dead yet, but TRUST — which is an important facet of business — has been significantly eroded.

I’ll have more to say about THE LOSERS in my PTC portfolio in an upcoming episode.

Very good Peter. This insight about investing kinda makes you take a whole new look at ptc’s and Internet marketing in general. Several months ago, this marketer sent me an email regarding Pay-to-click and issued a challenge. He said to join Neobux with, stick to it for six months, clicking all available ads every day, putting no personal money into it. So far so good. About 4 months into accepting his challenge, just over 100 RR’s, about .50 per day. Investing back in and taking none out until top upgrade is paid is the long term goal. He said to treat it like a 10K a month business from day one and see if it makes a difference. I will give you a full report when six months is totally up. Great articles and thanks for the great insights!

Dear Mr. Peter,

I don’t have any different idea than re-investing whatever earned from the pay-to-click sites back to them. Not only that gradually I will improve in investing from my pocket to these kind of sites, though I am not sure about the future of the pay -to- click sites.